Now you know how to build a Fan Gann, and you can move on to the most important part of this article – the rules for trading the Fan Gann strategy. All you have to do is just lay the Fan Gunn over the 45 degree line you drew earlier. https://traderoom.info/6-strategies-to-find-a-cheap-programmer-for-your/ This is the easiest and most correct way to draw Gann angles. When analyzing multiple charts with a Gann fan, it may be apparent that the tool is not always useful. Don’t go against the market trend and trade in liquid markets.

A 1×1 angle offers a strong indication of support when an uptrend is in progress, and conversely may signal a reversal when prices decline below the 1×1 angle. When this decline occurs, it can be expected that the prices will then drop to the next angle (in this case, the 2×1). Day traders globally use the Gann theory for intraday trading. Among his theories, the square of 9 method is the most popular. This method helps to make price forecasts by identifying the alignment of price and time.

Gann technical indicator calculation method

As a trader zooms in and out, the line will stay at the same angle, but its position on the chart will change. Gann theorised that once the price had broken through one angle, it would likely head to the next. As a result, we could have predicted that momentum was likely to continue to the 4×1 line and enter a position to catch the move. Alternatively, if traders had entered a trade on the reversal at the 2×1 line, denoted by the dashed line, they could take partial profits at both the 3×1 and 4×1 lines. W.D. Gann, the creator of Gann fans, found the 45-degree angle to be the ideal angle for charting based on his theories regarding the balance of time and price. Gann’s strategy allows you to move on a new trend for as long as possible, and with the help of the Fan Gann indicator, we can determine the ideal time for profit.

How do you trade like a hedge fund trader?

- Using derivatives. Hedge funds often take advantage of financial derivative contracts such as options, forwards and futures.

- Long-short trading strategy.

- Create a portfolio of trades.

- Don't overleverage your trades.

- Perform your analysis.

- Manage your exit points.

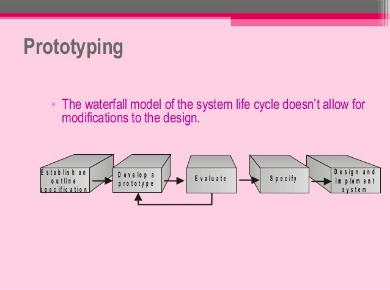

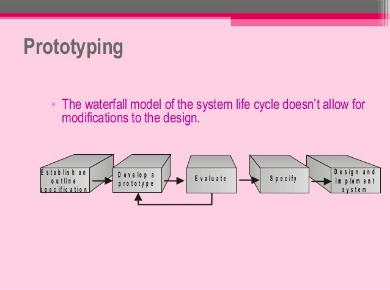

The Gann principle can be used to identify trend changes, support and resistance levels, and turning points in market cycles. Traders who use the Gann principle believe that it can help them make more accurate predictions about price movements and give them an edge in the market. The tool, drawn from a trend reversal point, consists of nine diagonal lines called Gann angles.

Gann Fan Trading Strategy: Example

These are the levels that Gann believed were the most important to watch when trading. Gann that is believed to indicate significant changes in market conditions. Its effectiveness depends on picking high / low trend reversal points. TradingView, a free charting platform, offers Gann Fan tools for free. I finally made about 139 records, which are of course not that numerous, but still sufficient to draw certain conclusions and find out specific combinations of planets. Finally, I’ll have statistics that will clearly show which of the planet pairs and in which Aspect has the strongest influence on the market and in which direction.

Strategies for Trading Fibonacci Retracements – Investopedia

Strategies for Trading Fibonacci Retracements.

Posted: Fri, 24 Mar 2017 17:11:11 GMT [source]

Trading without using a stop loss is like trying to drive a car without brakes. So always be sure to use one every time you enter the market. The image starts with two tops, which are directed downwards. These two tops are marked with the blue thick line and they are used as a base for the Gann Grid indicator.

What is Gann theory?

The strength (or weakness) of a price move, is gauged with respect to the areas of the fan that price is trading. The next step is to remove the time factor by deleting all the candlesticks/bars that are not turning points. After all, what we are really interested in is the direction of the market. That is all for the part, devoted to the analysis of the specific planet combinations in the Cosmogram. In the next part, I will describe the results of my studies and my research – the method of combined application of astrology laws and the Square of 9.

In this FXOpen article, we’ll dive into two of the most popular Gann indicators, Gann angles and Gann fans, and look at how they work, investigate their uses, and explore their limitations. One of the main reasons that Gann levels outperform horizontal support and resistance levels is because financial markets are constantly moving. If you look closely at the graph, you can see the geometric figure, through the key points of which passes the Gann fan.

What is Gann Theory and How is It Used in Trading?

This trade should be held until the price breaks the same diagonal line in the bullish direction. Notice, the take profit signal comes approximately around the same level as the initial sell signal, which makes this trade a scratch. The first Gann trading method we will discuss revolves around the fan. We will go through setting entry and exit points on the chart based on Gann Fan signals. Also, we will implement some rules around how you can manage your stop loss when trading with the Gann fan.

TD Ameritrade Announces thinkorswim® Enhancements – Business Wire

TD Ameritrade Announces thinkorswim® Enhancements.

Posted: Tue, 31 Jan 2023 08:00:00 GMT [source]

One of the core principles of technical analysis is that prices move in trends. Subsequently, the goal of technical analysts is to identify the trend in its very early stages of development. While experienced traders may nod their head in agreement, often beginners face difficulties identifying the trend on the price chart. Trend is identified once the turning points of the market are spotted. The technique of spotting the tops and the bottoms on the chart is not clear to everyone and the procedure can become an unpleasant process of trial and error for newbies.

If the price drops below the 1х1 line, this is a reversal signal. According to Gann, the price should then drop down to the next trendline (the 2х1 ray). In other words, if one of the Gann Fan rays is broken, the market is about to consolidate around the next ray. According to Gann, different trading tools move differently and have unique features.

- The Gann trading strategy lays down effective ways to study the market and predict the price movement of assets.

- The principle can be used to trade both long term and short term time frames, and can be applied in both bull and bear markets.

- Finally, I can find out the points to enter and exit a trade and act according to the rules of channel trading and trend trading strategies.

- The thick black line is the base movement we take for our grid.

- According to the new date, the planet will move along the Zodiac, and so all the five angles, identified before will also change.

Therefore, I should mark for myself, another discovered specific combination of planets that works for the BTCUSD. If Mercury enters Trine to Saturn, an impulse upward movement is 80% to occur. The most bullish pair for BTCUSD in Trine was Mercury – Saturn; 80% of all Trines for this pair corresponded to a bullish momentum. At the same time, 36% of all signals were followed by the trend reversal. The share of bullish signals, corresponding to this Aspect in the total mass was only 57%, bearish signals were in 20% of cases.

What is the best trading method?

- Trend trading.

- Range trading.

- Breakout trading.

- Reversal trading.

- Gap trading.

- Pairs trading.

- Arbitrage.

- Momentum trading.