You can also pay to upgrade the delivery speed of your ACH transfer if your financial institution offers the option. Some banks offer next-day delivery, usually for an extra cost. The automated clearing house (ACH) transfer network is like the postal service of the electronic funds transfer (EFT) universe, where individual ACH transactions are like pieces of mail.

- An ACH money transfer is the electronic movement of funds through an automatic clearing house.

- Same-Day ACH volume rose by 73.9% in 2021 from 2020, with a total of 603 million payments made.

- If a transaction fails, the RDFI typically has up to 48 hours to report it.

- Get more from a personalized relationship with a dedicated banker to help you manage your everyday banking needs and a J.P.

- Each month, the insurance company’s bank, the ODFI, requests a payment from your bank, the RDFI.

- In most cases, wires cannot be reversed or stopped, and you cannot retrieve funds sent by wire after approval.

Wires can be sent anywhere in the U.S. or overseas except to countries subject to U.S. sanctions, including Cuba, Iran, and North Korea. However, some online banks do not offer the option to send money by wire internationally, only domestically. Your bank sends the payment to the credit card company as scheduled. In this transaction, you are on the receiving end of a payment request. Most consumers use ACH to pay bills and send money person-to-person payments. Banks and third-party apps such as rely on ACH to move money between friends and family or, in some cases, pay bills.

Automated clearing house

Chase online lets you manage your Chase accounts, view statements, monitor activity, pay bills or transfer funds securely from one central place. For questions or concerns, please contact Chase customer service or let us know about Chase complaints and feedback. For transfers to/from a non-Chase account, it typically takes 2-3 business days to complete. ACH transactions can be a secure and convenient way to automatically pay your bills, get paid and make money transfers.

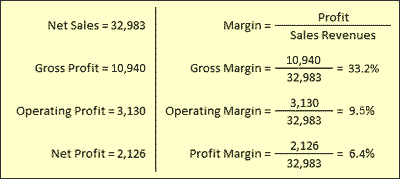

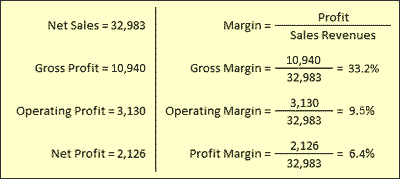

Getting paid by bank transfer without using paper checks or credit cards is as simple as 1, 2, 3. ACH transfers are generally free or low-cost, while wire transfers can cost anywhere from $25 to $50. ACH transfers are regulated and designed to prevent fraudulent transactions.

What are potential advantages of ACH?

Some international ACH transactions (IATs) may be possible depending on your bank or destination, but they’re not yet widespread. Once a wire transfer payment is sent and accepted, the transaction cannot be reversed. By reducing failed and late payments, ACH Debit frees up the time businesses otherwise spend on dealing with these issues, creating more space to get other essential tasks done.

Morgan Securities LLC (JPMS), a registered broker-dealer and investment adviser, member FINRA and SIPC. Insurance products are made available through Chase Insurance Agency, Inc. (CIA), a licensed insurance agency, doing business as Chase Insurance Agency Services, Inc. in Florida. Certain custody and other services are provided by JPMorgan Chase Bank, N.A. JPMS, CIA and JPMCB are affiliated companies under the common control of JPMorgan Chase & Co. Then you can typically access your money in 2-3 business days. An organization called Nacha manages and governs the ACH network.

How to Exchange Currency Online and What to Consider First

This drastically reduces the time required to access the scheme, as well as simplifying ongoing costs and providing a payment solution that is ready to use immediately. Learn more about the two routes to getting set up with ACH, or find out about getting started collecting ACH payments here. Transaction types include government, consumer, and business-to-business transactions, as well as international payments. Anyone with a bank account within the Automated Clearing House network can receive an ACH payment. ACH network banks are mostly U.S.-based, but some operate in the U.K. If you’re being paid by a company as a vendor through a platform such as Gusto or Bill.com, it might cost you nothing to accept an ACH payment.

Person-to-person (P2P) services are often easy and inexpensive to use. Popmoney, for example, enables three-day standard transfers from bank accounts. Some financial institutions also offer bill payment, which allows you to schedule and pay bills electronically using ACH transfers.

What’s the difference between an ACH transfer and a wire transfer?

Direct payments can be used by individuals, businesses, and other organizations to send money. For example, if you’re paying a bill online with your bank account, that’s an ACH direct payment. Social payment apps such as Venmo and Zelle also use the network when you send money to friends and family. You can also use Zelle, a payment app that works directly with hundreds of banks and credit unions.

A Guide to ACH: How Money Moves Around Without Checks – U.S. News & World Report

A Guide to ACH: How Money Moves Around Without Checks.

Posted: Thu, 27 Apr 2023 07:00:00 GMT [source]

We’re the Consumer Financial Protection Bureau (CFPB), a U.S. government agency that makes sure banks, lenders, and other financial companies treat you fairly. Sign up for Shopify’s free trial to access all of the tools and services you need to start, run, and grow your business. In the meantime, start Ach transfer building your store with a free 3-day trial of Shopify. However, there are numerous ways an ACH can be stopped, reversed, or canceled, in certain circumstances, such as duplicate payments or an incorrect payment amount. We believe everyone should be able to make financial decisions with confidence.

Many financial institutions also offer same-day ACH transfers for an additional fee. RDFIs often hold transactions for an additional one to two business days, which allows time to verify the debited bank account holds sufficient funds to cover the transaction. This brings the total transfer time to an average of one to three business days. While wire transfers are faster on average, exceptions do exist. Domestic wires can take as long as a few hours, or overnight if a cutoff is missed.

No need to collect or provide banking information on your own, Square can collect it through our secure payment network to help protect both parties. In general, wires have higher transfer limits, but you may need to call on the phone or visit a branch in person to make a transfer. For example, you might only be able to send up to $500,000 to a title company for a home purchase online, but there’s no limit if you visit a branch or call in.

In rare instances, a debit payment can be successfully disputed outside these timelines. ACH costs are generally lower than other popular payment methods, typically costing an average of one dollar per transaction, depending on transaction volume. Some businesses however, may have to pay a separate fee from $5 to $30 per month to use ACH for transferring money. There are also additional potential charges like return fees (from $2 to $5 per return) and reversal or chargeback fees ($5 to $25). Generally, the greater the volume of ACH transactions, the less the fees per transaction. ACH money transfers are often free for the sender but can require a fee for the receiver.

It can also help you avoid missing due dates if your account is set up to automatically pay your bills on time. Plus, payment encryption could make ACH payments more secure than writing checks. An ACH is an electronic fund transfer made between banks and credit unions across what is called the Automated Clearing House network. On average, ACH transfers take about one to three business days to complete. All banks in the United States can use ACH, as all that’s needed to receive an ACH transfer is a valid bank account and routing number.

- ACH payments make the payment process easier for potential customers compared to writing a check, increasing chances of converting them to a sale.

- “Bank of America” and “BofA Securities” are the marketing names used by the Global Banking and Global Markets divisions of Bank of America Corporation.

- Consumers also have up to 60 days to dispute unauthorized or incorrect ACH debit transactions.

You can use cash for an in-person transfer at a Western Union branch if you don’t want to submit bank account information, or you can carry out transactions online. The recipient picks up the money at a specified location at the other end, and is identified through personal information like their name and address. A wire transfer is another way to send or receive money electronically between individuals or financial institutions.